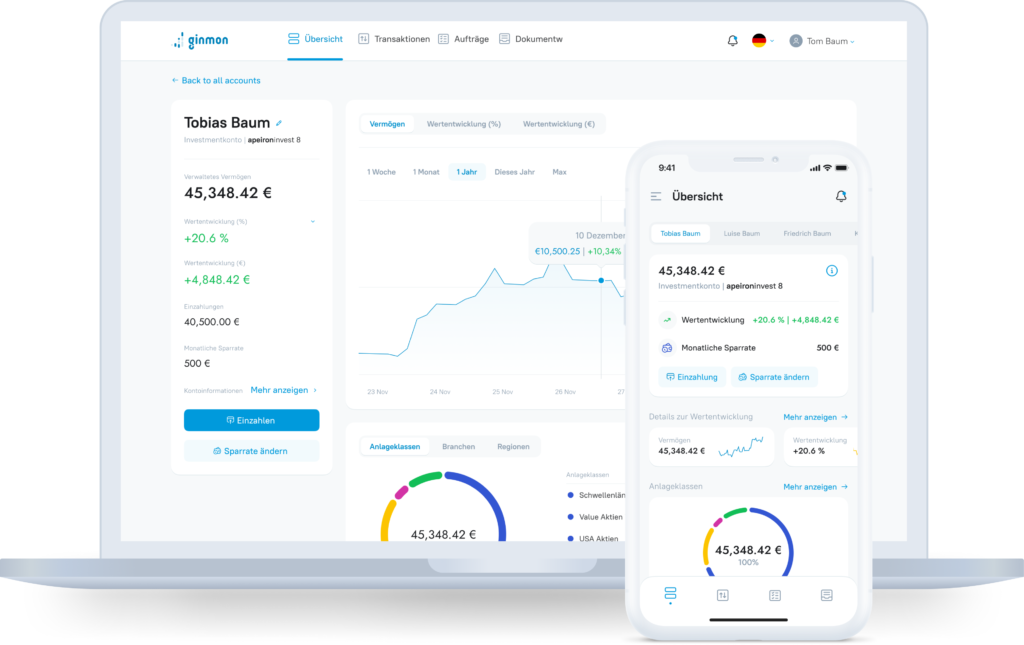

With Ginmon you get an investment that never loses sight of your pursued goal. And because goals change, investments at Ginmon are flexible. Change of strategy, adjustment or pause of the savings rate as well as access to your saved assets are of course possible at any time.

- Independence: Own regulation according to §32 of the German Banking Act

- Security: Safekeeping of the investment amounts as a special fund

- Reachable: Personal contact for questions and exclusive service

As an invitee, you invest the first €1,000 free of charge at Ginmon, for life.

As an invitee, you invest the first €1,000 free of charge at Ginmon, for life.