Einfach intelligent Geld anlegen

- mit wissenschaftlich fundierter Anlagestrategie

- auf Basis kostengünstiger ETFs

- inklusive professionellem Risikomanagement

+++ Jetzt Renditestarke Zins-Angebote sichern: 3,58 % p.a. Ginmon TopZins oder 5,30 % p.a. Geldmarkt-US +++

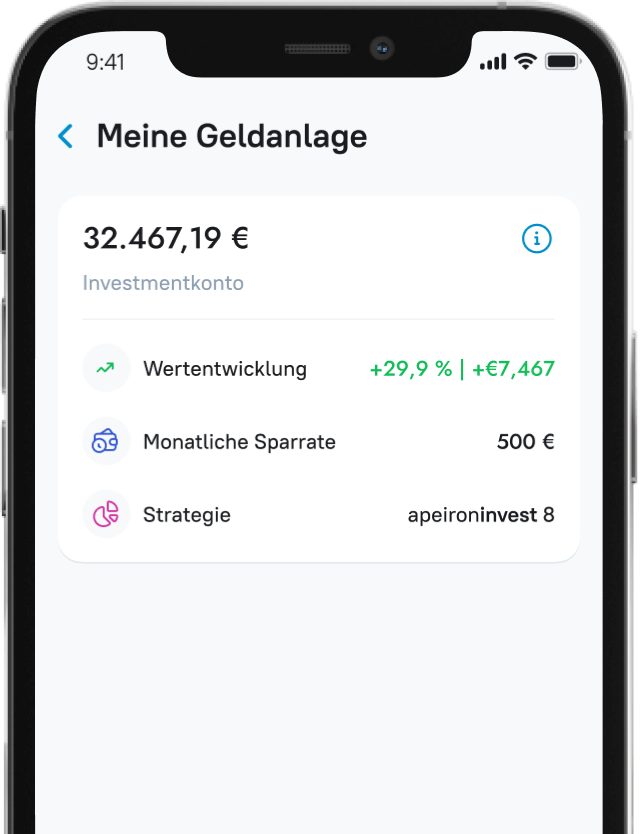

Wir investieren für Sie in die beste Auswahl an ETFs, sodass Sie jährlich bis zu 6,7 % an Wertzuwachs auf dem Depot sehen. Darum vertrauen uns Anleger in Deutschland mittlerweile mehr als 300 Millionen € an.

Anders als viele digitale Geldanlagen bietet Ginmon das Beste aus zwei Welten:

Ginmon ist Ihr idealer Partner für die Planung und Umsetzung von Vermögensaufbau, professionellem Vermögens-Management und Ruhestandsplanung.

Sie profitieren von wissenschaftlich fundierten Anlage-Strategien auf Basis kostengünstiger ETFs, die dank Nobelpreis-gekrönter Erkenntnisse langfristig überlegene Renditen sowie ein professionelles Risikomanagement aufweisen, das Ihr Portfolio bei Marktveränderungen ganz automatisch korrigiert.

*4-Jahres-Rendite eines ausgewogenen Portfolios nach Gebühren und Steuern

Nein, Sie können Ihr Ginmon Depot auszahlen, wann Sie wollen.

Ihren Sparplan können Sie so oft und so lange pausieren, wie Sie es wünschen. Keinerlei extra Gebühren oder Sperrfristen.

Gute Frage! Lassen Sie uns die schlimmsten Szenarien doch einmal durchgehen.

Fall 1 - Ginmon geht von heute auf morgen pleite.

In diesem sehr unwahrscheinlichen Fall, würde Ihr Depot unberührt bleiben.

Das Depot ist sicher bei unserer Partnerbank verwahrt.

Fall 2 - Die Partnerbank geht von heute auf morgen pleite.

Bleiben Sie unbesorgt, auch das ist sehr unwahrscheinlich.

Und selbst dann ist Ihr angelegtes Geld komplett geschützt.

Ihr Geld gilt als Sondervermögen und wird im schlimmsten Falle automatisch an eine Partnerbank Ihrer Wahl übertragen. Am Depot-Inhalt ändert sich dadurch nichts.

Fall 3 - Der Kapitalmarkt bricht ein.

Das sollte den langfristigen Anleger kaum interessieren.

Der weltweite Kapitalmarkt hat sich ausnahmslos nach jeder Krise erholt und neue Kursrekorde erzielt.

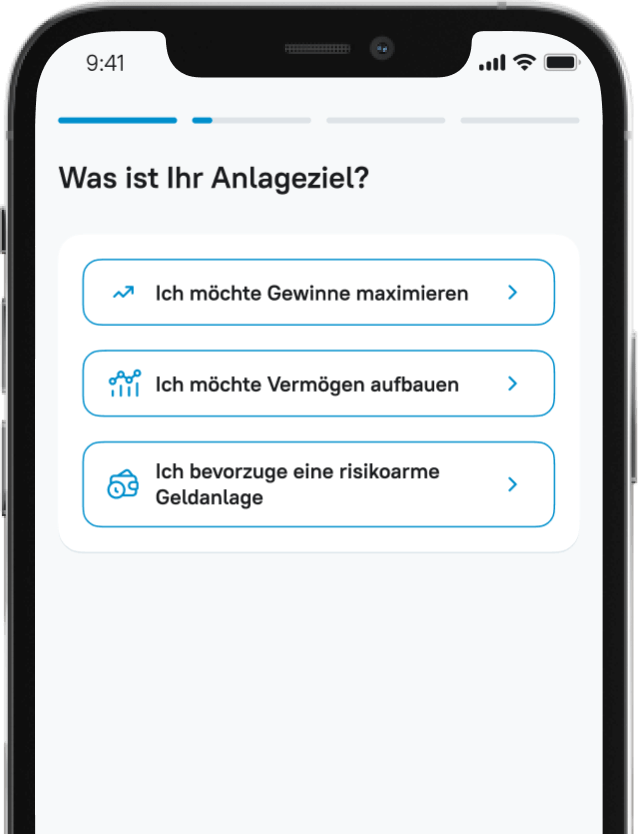

Zuerst melden Sie sich an und beantworten 8 Fragen zu Ihren Anlage-Wünschen.

Das dauert keine 3 Minuten.

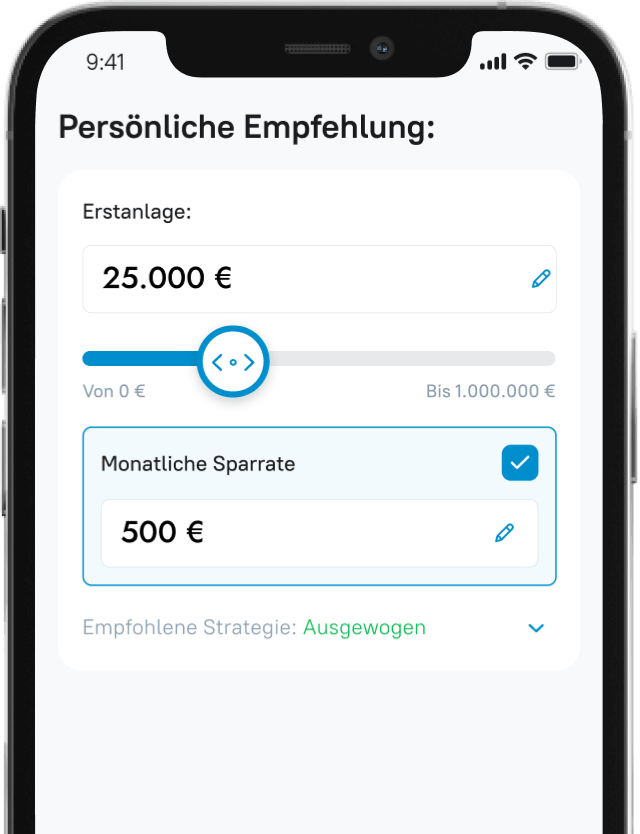

Jetzt bekommen Sie schon Ihren unverbindlichen Anlagevorschlag.

Als Nächstes legitimieren Sie sich per Video.

Daraufhin sagen Sie uns, wie Sie Ihr Geld auf Ihr Depot einzahlen möchten.

• via Überweisung

• via Dauerauftrag

• via Lastschrift (Bankeinzug)

Sobald das Geld da ist, investieren wir es in Ihre Wunschstrategie.

Selbstverständlich können Sie Ihre Strategie oder Einzahlung jederzeit kostenfrei ändern oder Ihr Depot auszahlen lassen.

Wir erstellen gemeinsam Ihre individuelle Anlagestrategie.

Dieses basiert auf Ihrer persönlichen Risikoneigung und Ihren Erfahrungen am Kapitalmarkt, damit Sie mit Ihrer Geldanlage ruhig schlafen können.

Wir eröffnen Ihr Depot und investieren für Sie automatisch.

Ihre Anlage haben wir täglich im Blick und stellen sicher, dass sie stets Ihren persönlichen Vorlieben entspricht.

Sie schauen Ihrer Geldanlage beim Wachsen zu und bleiben jederzeit flexibel.

Ein- und Auszahlungen sind jederzeit möglich.

© Ginmon Vermögensverwaltung GmbH