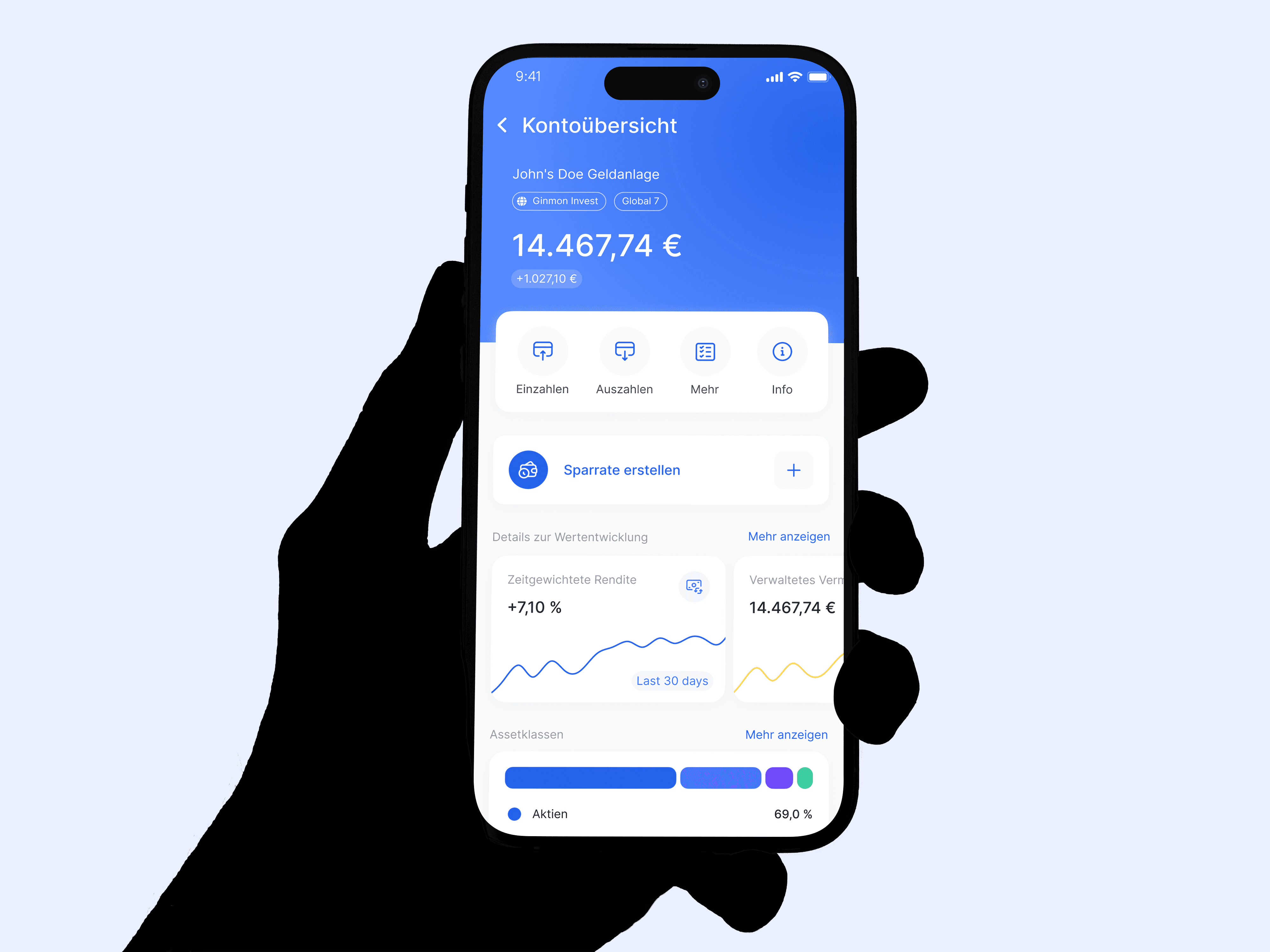

Get the app

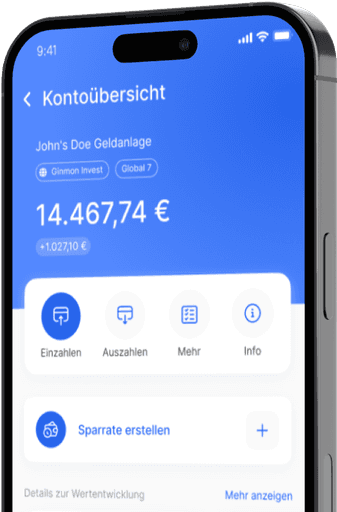

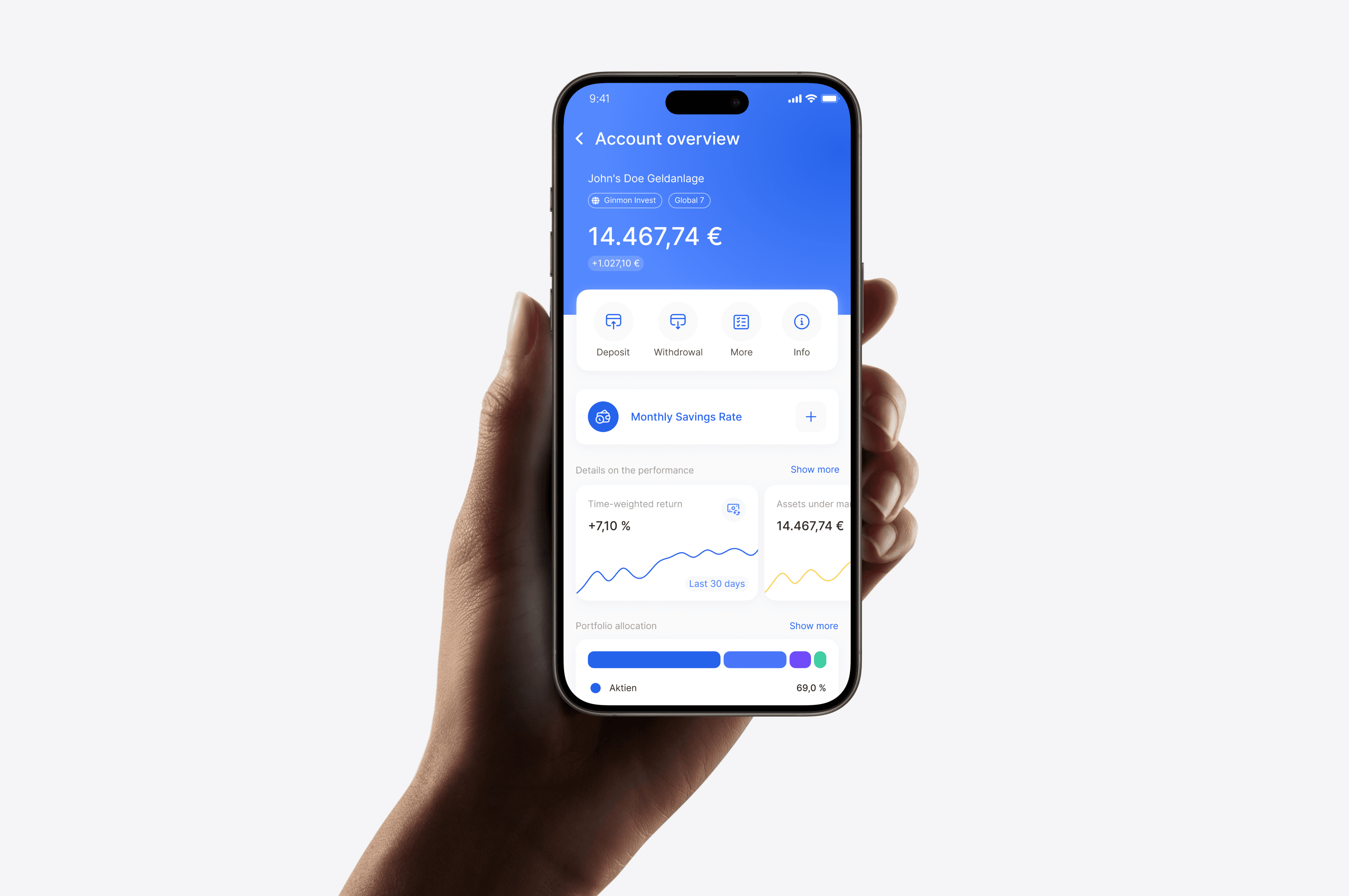

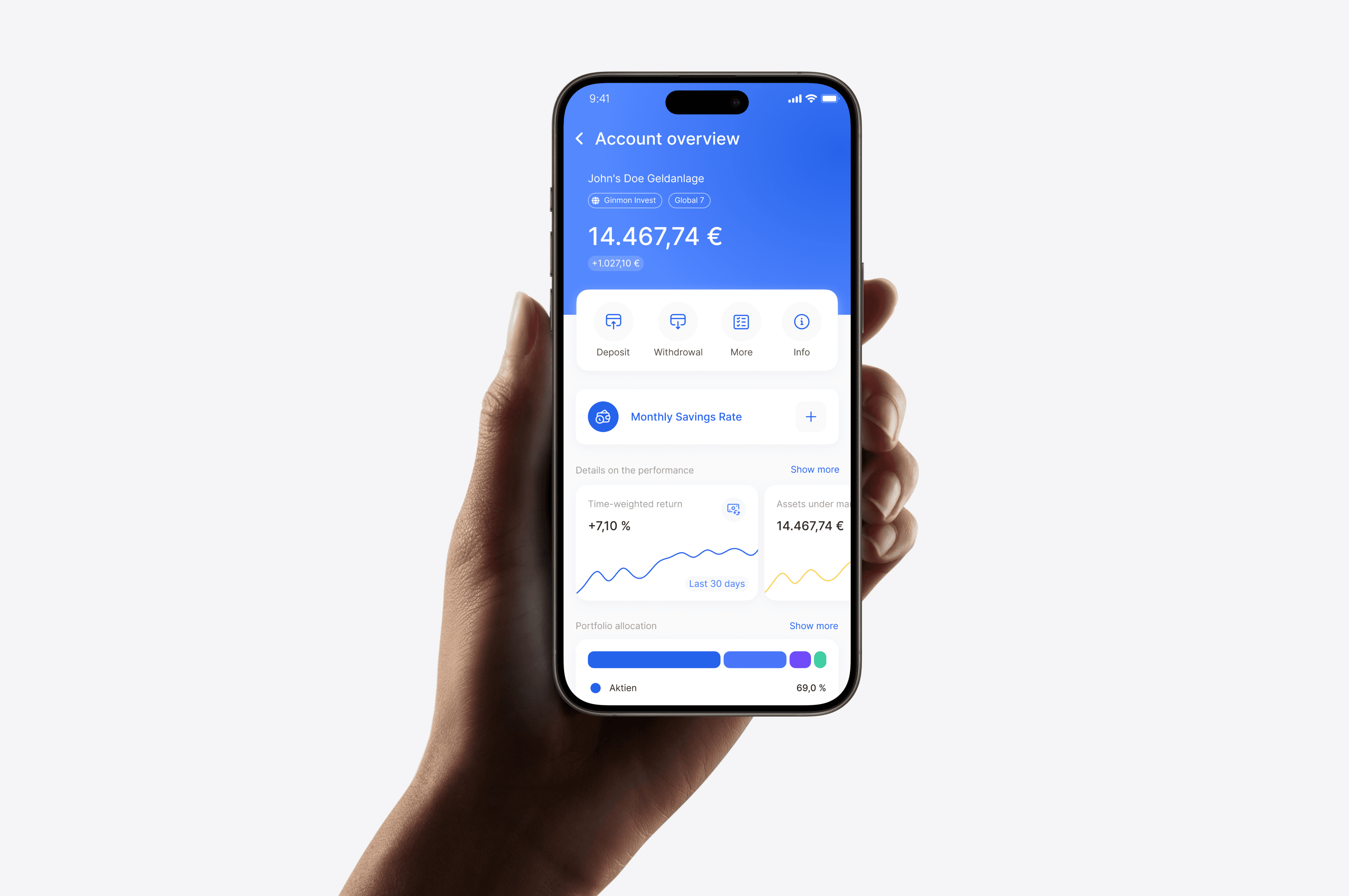

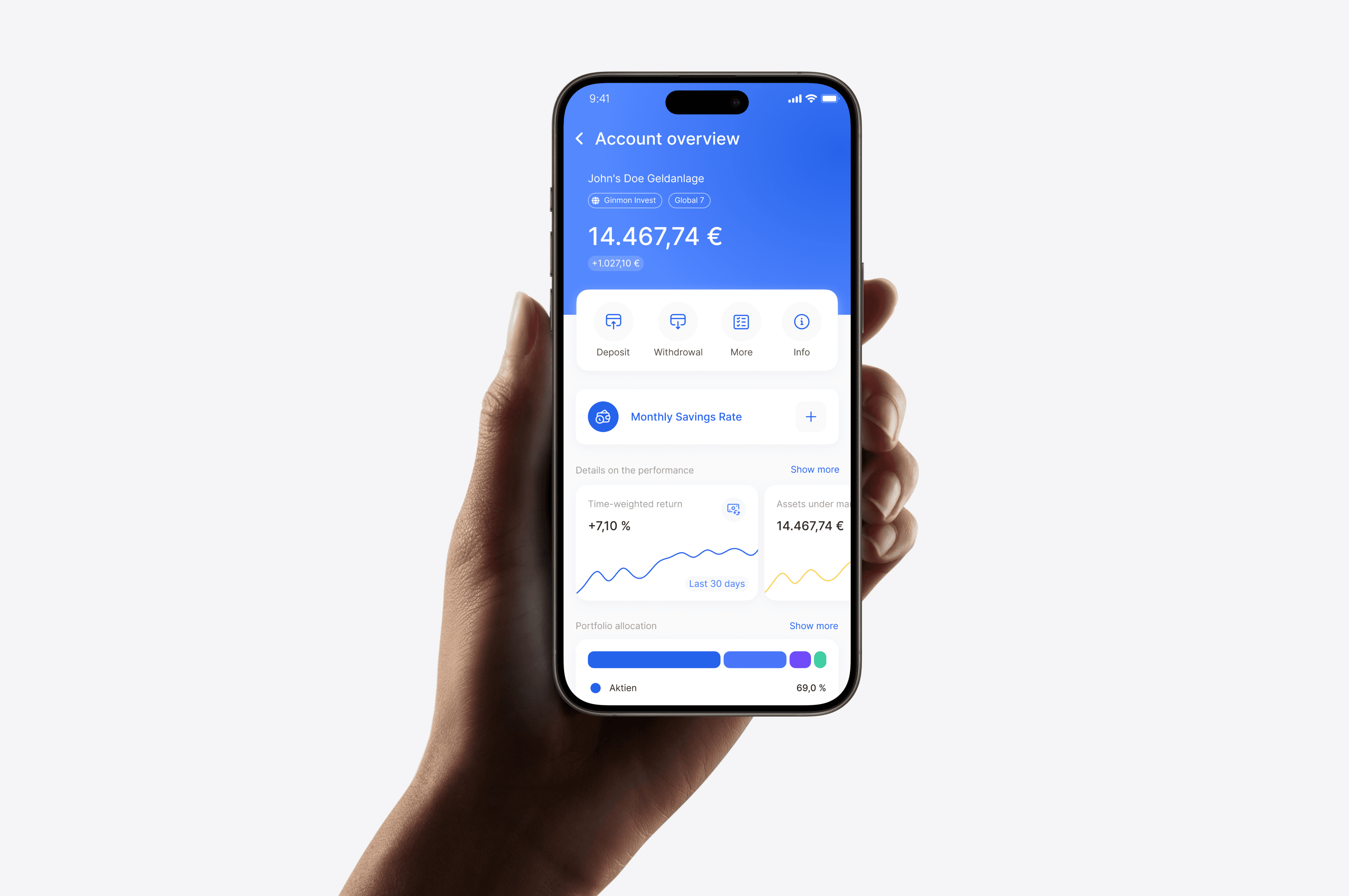

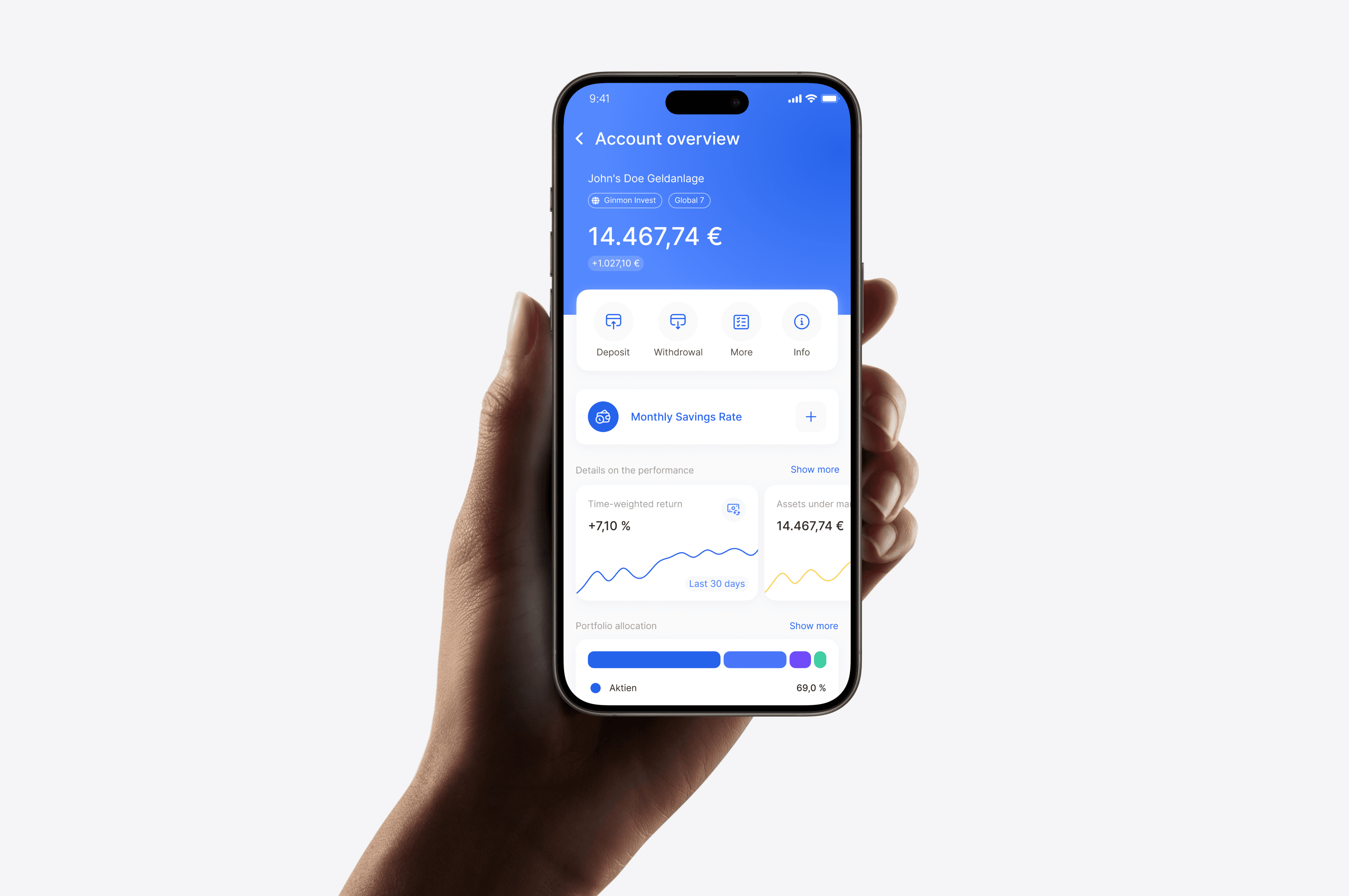

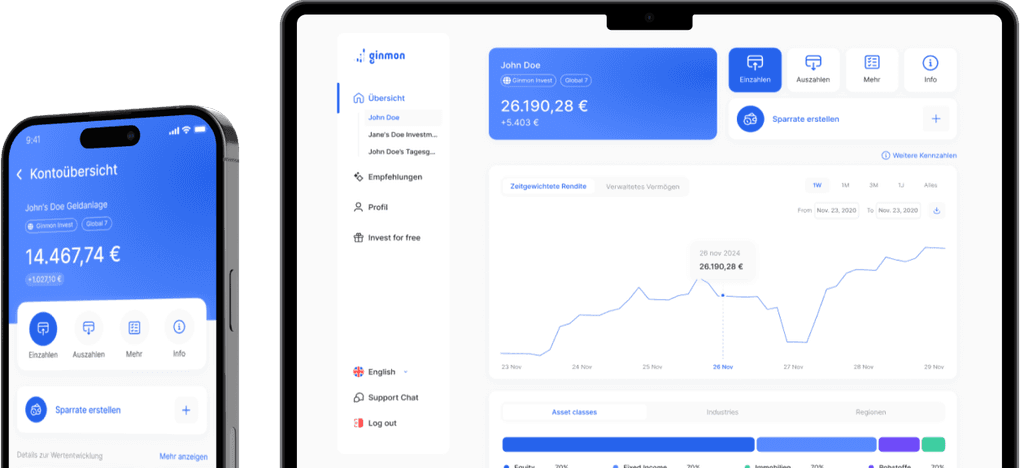

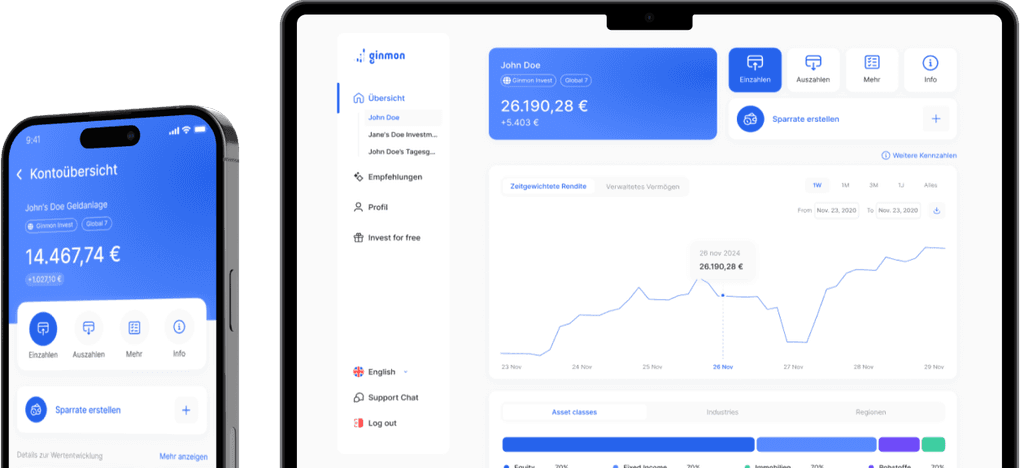

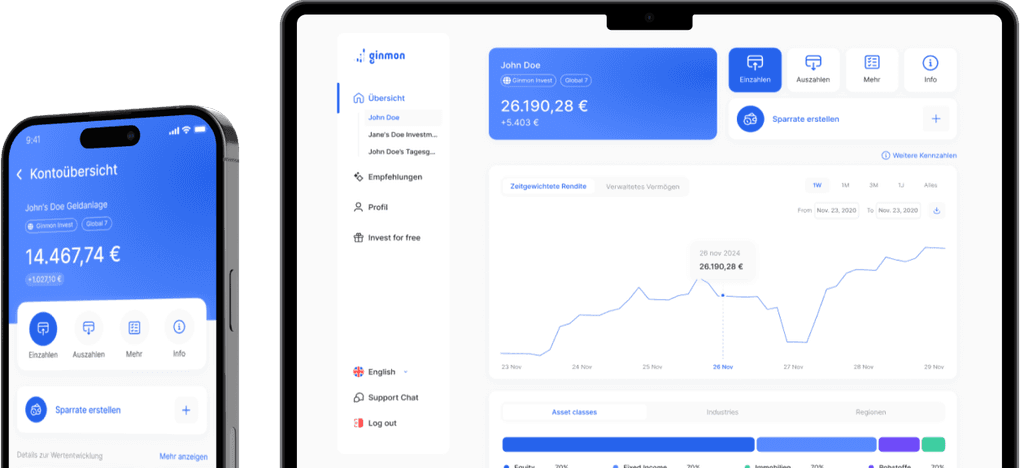

Invest simply intelligently

With a science-based investment strategy

Based on low-cost ETFs

With professional risk management

on Google & Trustpilot

€400M

Assets Under Management

Achieve your financial

goals

Proven security

EU Deposit Insurance

All investments are protected as segregated assets

Regulated under strict German BaFin supervision

Personal contact

Ideal combination: digital, but personal

Available via phone, email, chat, and WhatsApp

Personal advisor from €50K investment volume

Independent

100% independent product selection

No commissions

No hidden costs

The right solution for every goal

The next generation of wealth management

The next generation of wealth management

The next generation of wealth management

Broker

Broker

Robo-Advisor

Robo-Advisor

Ginmon

Ginmon

Cost-efficient ETFs

Cost-efficient ETFs

Automated portfolio management

Automated portfolio management

Active risk management

Active risk management

Automated tax optimization

Automated tax optimization

Goal-oriented financial planning and solutions

Goal-oriented financial planning and solutions

Personal advice and customer service

Personal advice and customer service

Featured in the media

Ginmon has been honoured with numerous awards and has received over 500 positive mentions in German media

Featured in the media

Ginmon has been honoured with numerous awards and has received over 500 positive mentions in German media

Featured in the media

Ginmon has been honoured with numerous awards and has received over 500 positive mentions in German media

15,9%

Ginmon

Fintego

14,6%

Whitebox

13,5%

Quirion

13,3%

Easyfolio

12,1%

-1.0%

Scalable Capital

4-year return of a balanced portfolio after fees and taxes

15,9%

Ginmon

Fintego

14,6%

Whitebox

13,5%

Quirion

13,3%

Easyfolio

12,1%

-1.0%

Scalable Capital

4-year return of a balanced portfolio after fees and taxes

15,9%

Ginmon

Fintego

14,6%

Whitebox

13,5%

Quirion

13,3%

Easyfolio

12,1%

-1.0%

Scalable Capital

4-year return of a balanced portfolio after fees and taxes

15,9%

Ginmon

Fintego

14,6%

Whitebox

13,5%

Quirion

13,3%

Easyfolio

12,1%

-1.0%

Scalable Capital

4-year return of a balanced portfolio after fees and taxes

"Among all providers in our comparison, Ginmon performed the best."

Source: Frankfurter Allgemeine Zeitung, ‘Finanz-Roboter im Härtetest’, published on 01.05.2021

What our customers say

Don’t worry about anything, just determine your risk profile and invest. Simple, low-cost investment. I also liked the recent excellent returns.

Christoph Decker

Four years ago, I entered the world of robo-advisors. It has been a very rewarding experience with a remarkable return on my investment.

Stephan Weber

The independence from a large investment group is a big plus. I also tried the market leader, but I was very unsatisfied with it.

Eduard Hoffman

What our customers say

Don’t worry about anything, just determine your risk profile and invest. Simple, low-cost investment. I also liked the recent excellent returns.

Christoph Decker

Four years ago, I entered the world of robo-advisors. It has been a very rewarding experience with a remarkable return on my investment.

Stephan Weber

The independence from a large investment group is a big plus. I also tried the market leader, but I was very unsatisfied with it.

Eduard Hoffman

What our customers say

Don’t worry about anything, just determine your risk profile and invest. Simple, low-cost investment. I also liked the recent excellent returns.

Christoph Decker

Four years ago, I entered the world of robo-advisors. It has been a very rewarding experience with a remarkable return on my investment.

Stephan Weber

The independence from a large investment group is a big plus. I also tried the market leader, but I was very unsatisfied with it.

Eduard Hoffman

What our customers say

Don’t worry about anything, just determine your risk profile and invest. Simple, low-cost investment. I also liked the recent excellent returns.

Christoph Decker

Four years ago, I entered the world of robo-advisors. It has been a very rewarding experience with a remarkable return on my investment.

Stephan Weber

The independence from a large investment group is a big plus. I also tried the market leader, but I was very unsatisfied with it.

Eduard Hoffman

Other questions?

What is Ginmon?

Spelling: [ɡin moɴ]

Ginmon means "silver gate" in Japanese and is an independent WealthTech (Digital Asset Manager) founded in December 2014, consisting of a team of dynamic IT and finance experts.

Our goal is to provide an independent, automated, highly diversified and highly scientific investment for you, so that you can save money and time. Together we will find the way through the silver gate to the well-deserved prosperity for your financial goals.

“Many people overlook the silver lining because they are waiting for gold.”

(Maurice Setter)

What does Ginmon offer me?

Ginmon offers a transparent and fully automated investment solution that enables you to invest your saved wealth cost-effectively into established investment forms with a clear investment strategy and ease of use.

Through user-friendly technology combined with understandable investment products, Ginmon provides a completely new way of investing.

For more information on our investment strategies, please visit our Investment philosophy.

How does the registration process work?

First, you register and answer 8 questions about your investment goals.

This takes less than 3 minutes.

Now you will receive your personalized investment proposal.

Next, you verify your identity via video ident.

You then tell us how you would like to deposit your money into your custody account.

• via SEPA credit transfer

• via recurring SEPA credit transfer

• via SEPA direct debit

As soon as the money arrives, we invest it in your personalised ETF strategy.

Of course, you can change your strategy or deposit at any time, free of charge, or even have all your investments paid out.

What if I want my money? Do I have to wait?

No, you can withdraw your Ginmon deposit when you want.

You can pause your savings plan as often and as long as you want. No extra fees or lock-up periods.

What if Ginmon no longer exists?

Good question! Let's go through the worst-case scenarios.

Case 1 - Ginmon goes bankrupt.

In this very unlikely case, your deposit would remain unaffected.

The custody account is safely held at our partner bank.

Case 2 - The partner bank goes bankrupt.

Don't worry, this is also very unlikely.

In fact, your invested money is completely protected.

In this case, your securities are held in a so called “segregated account” that, in the worst case, is automatically transferred to a partner bank of your choice. Three will be no change to your account, and you will remain invested.

Case 3 - The capital market collapses.

While capital markets are volatile, this is of less concern to the long-term investor.

The global capital market has, without exception, recovered after every crisis and achieved steady 6-7% p.a. returns over longer period of time.

Other questions?

What is Ginmon?

Spelling: [ɡin moɴ]

Ginmon means "silver gate" in Japanese and is an independent WealthTech (Digital Asset Manager) founded in December 2014, consisting of a team of dynamic IT and finance experts.

Our goal is to provide an independent, automated, highly diversified and highly scientific investment for you, so that you can save money and time. Together we will find the way through the silver gate to the well-deserved prosperity for your financial goals.

“Many people overlook the silver lining because they are waiting for gold.”

(Maurice Setter)

What does Ginmon offer me?

Ginmon offers a transparent and fully automated investment solution that enables you to invest your saved wealth cost-effectively into established investment forms with a clear investment strategy and ease of use.

Through user-friendly technology combined with understandable investment products, Ginmon provides a completely new way of investing.

For more information on our investment strategies, please visit our Investment philosophy.

How does the registration process work?

First, you register and answer 8 questions about your investment goals.

This takes less than 3 minutes.

Now you will receive your personalized investment proposal.

Next, you verify your identity via video ident.

You then tell us how you would like to deposit your money into your custody account.

• via SEPA credit transfer

• via recurring SEPA credit transfer

• via SEPA direct debit

As soon as the money arrives, we invest it in your personalised ETF strategy.

Of course, you can change your strategy or deposit at any time, free of charge, or even have all your investments paid out.

What if I want my money? Do I have to wait?

No, you can withdraw your Ginmon deposit when you want.

You can pause your savings plan as often and as long as you want. No extra fees or lock-up periods.

What if Ginmon no longer exists?

Good question! Let's go through the worst-case scenarios.

Case 1 - Ginmon goes bankrupt.

In this very unlikely case, your deposit would remain unaffected.

The custody account is safely held at our partner bank.

Case 2 - The partner bank goes bankrupt.

Don't worry, this is also very unlikely.

In fact, your invested money is completely protected.

In this case, your securities are held in a so called “segregated account” that, in the worst case, is automatically transferred to a partner bank of your choice. Three will be no change to your account, and you will remain invested.

Case 3 - The capital market collapses.

While capital markets are volatile, this is of less concern to the long-term investor.

The global capital market has, without exception, recovered after every crisis and achieved steady 6-7% p.a. returns over longer period of time.

Other questions?

What is Ginmon?

Spelling: [ɡin moɴ]

Ginmon means "silver gate" in Japanese and is an independent WealthTech (Digital Asset Manager) founded in December 2014, consisting of a team of dynamic IT and finance experts.

Our goal is to provide an independent, automated, highly diversified and highly scientific investment for you, so that you can save money and time. Together we will find the way through the silver gate to the well-deserved prosperity for your financial goals.

“Many people overlook the silver lining because they are waiting for gold.”

(Maurice Setter)

What does Ginmon offer me?

Ginmon offers a transparent and fully automated investment solution that enables you to invest your saved wealth cost-effectively into established investment forms with a clear investment strategy and ease of use.

Through user-friendly technology combined with understandable investment products, Ginmon provides a completely new way of investing.

For more information on our investment strategies, please visit our Investment philosophy.

How does the registration process work?

First, you register and answer 8 questions about your investment goals.

This takes less than 3 minutes.

Now you will receive your personalized investment proposal.

Next, you verify your identity via video ident.

You then tell us how you would like to deposit your money into your custody account.

• via SEPA credit transfer

• via recurring SEPA credit transfer

• via SEPA direct debit

As soon as the money arrives, we invest it in your personalised ETF strategy.

Of course, you can change your strategy or deposit at any time, free of charge, or even have all your investments paid out.

What if I want my money? Do I have to wait?

No, you can withdraw your Ginmon deposit when you want.

You can pause your savings plan as often and as long as you want. No extra fees or lock-up periods.

What if Ginmon no longer exists?

Good question! Let's go through the worst-case scenarios.

Case 1 - Ginmon goes bankrupt.

In this very unlikely case, your deposit would remain unaffected.

The custody account is safely held at our partner bank.

Case 2 - The partner bank goes bankrupt.

Don't worry, this is also very unlikely.

In fact, your invested money is completely protected.

In this case, your securities are held in a so called “segregated account” that, in the worst case, is automatically transferred to a partner bank of your choice. Three will be no change to your account, and you will remain invested.

Case 3 - The capital market collapses.

While capital markets are volatile, this is of less concern to the long-term investor.

The global capital market has, without exception, recovered after every crisis and achieved steady 6-7% p.a. returns over longer period of time.

Other questions?

What is Ginmon?

Spelling: [ɡin moɴ]

Ginmon means "silver gate" in Japanese and is an independent WealthTech (Digital Asset Manager) founded in December 2014, consisting of a team of dynamic IT and finance experts.

Our goal is to provide an independent, automated, highly diversified and highly scientific investment for you, so that you can save money and time. Together we will find the way through the silver gate to the well-deserved prosperity for your financial goals.

“Many people overlook the silver lining because they are waiting for gold.”

(Maurice Setter)

What does Ginmon offer me?

Ginmon offers a transparent and fully automated investment solution that enables you to invest your saved wealth cost-effectively into established investment forms with a clear investment strategy and ease of use.

Through user-friendly technology combined with understandable investment products, Ginmon provides a completely new way of investing.

For more information on our investment strategies, please visit our Investment philosophy.

How does the registration process work?

First, you register and answer 8 questions about your investment goals.

This takes less than 3 minutes.

Now you will receive your personalized investment proposal.

Next, you verify your identity via video ident.

You then tell us how you would like to deposit your money into your custody account.

• via SEPA credit transfer

• via recurring SEPA credit transfer

• via SEPA direct debit

As soon as the money arrives, we invest it in your personalised ETF strategy.

Of course, you can change your strategy or deposit at any time, free of charge, or even have all your investments paid out.

What if I want my money? Do I have to wait?

No, you can withdraw your Ginmon deposit when you want.

You can pause your savings plan as often and as long as you want. No extra fees or lock-up periods.

What if Ginmon no longer exists?

Good question! Let's go through the worst-case scenarios.

Case 1 - Ginmon goes bankrupt.

In this very unlikely case, your deposit would remain unaffected.

The custody account is safely held at our partner bank.

Case 2 - The partner bank goes bankrupt.

Don't worry, this is also very unlikely.

In fact, your invested money is completely protected.

In this case, your securities are held in a so called “segregated account” that, in the worst case, is automatically transferred to a partner bank of your choice. Three will be no change to your account, and you will remain invested.

Case 3 - The capital market collapses.

While capital markets are volatile, this is of less concern to the long-term investor.

The global capital market has, without exception, recovered after every crisis and achieved steady 6-7% p.a. returns over longer period of time.

Try it out now

With or without an investment goal. Create a

free investment proposal in just a few minutes.

Try it out now

With or without an investment goal. Create a

free investment proposal in just a few minutes.

Try it out now

With or without an investment goal. Create a

free investment proposal in just a few minutes.

on Google & Trustpilot

€400M

Assets Under Management

on Google & Trustpilot

€400M

Assets Under Management

² Verified customer reviews come from customers with whom we have a customer relationship under the same name, and the authenticity of the person has been verified through AML-compliant identification procedures (e.g. video identification procedure).