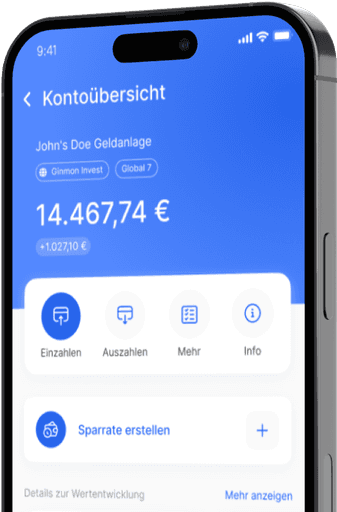

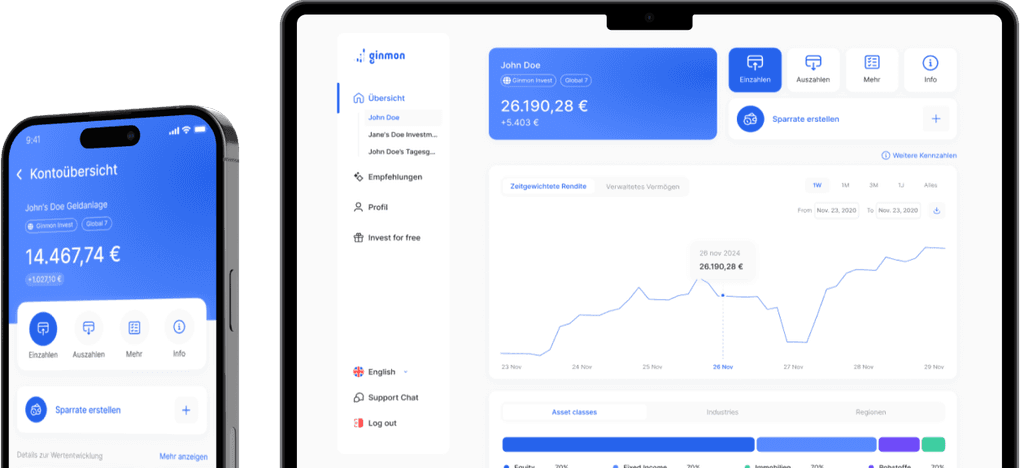

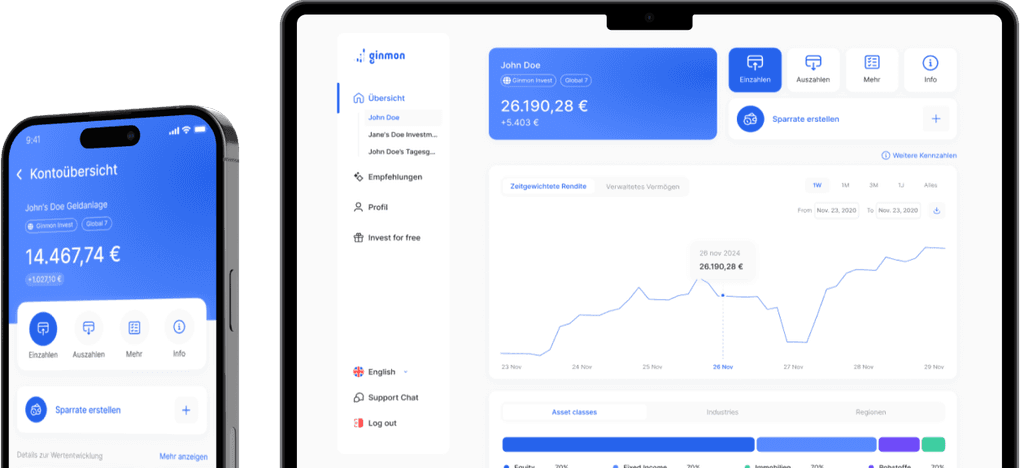

Ginmon Invest

Investing money successfully with a proven system.

ETF solutions for long-term wealth building

Strategies based on leading capital market research

Individually tailored to your risk profile

on Google & Trustpilot

€400M

Assets Under Management

on Google & Trustpilot

€400M

Assets Under Management

on Google & Trustpilot

€400M

Assets Under Management

on Google & Trustpilot

€400M

Assets Under Management

Superior returns through a scientific concept

Superior returns through a scientific concept

Asset management based on Nobel Prize-winning research and cost-efficient ETFs.

Asset management based on Nobel Prize-winning research and cost-efficient ETFs.

Expected return ⌀

Expected return ⌀

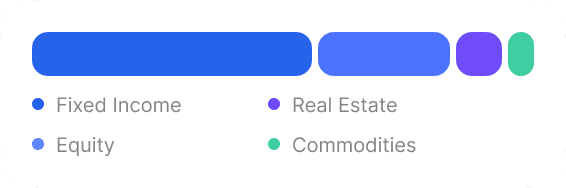

Investment in equities, bonds, real estate and commodities

Individually tailored to your own risk profile

Automatic risk management

Intelligent tax optimization

Also available as a sustainable option

All service fee from 0.60% p.a.

Example return for illustration purposes

Ginmon Invest supports your investment goals

Building wealth with ETFs

Investing assets for the long term

Making private provisions

Building wealth with ETFs

Investing assets for the long term

Making private provisions

Building wealth with ETFs

Investing assets for the long term

Making private provisions

Building wealth with ETFs

Investing assets for the long term

Making private provisions

Our investment strategies

Global Investment

Scientific factor investing

Overweighting of value and small caps

GDP-related weighting of world regions

Green Investment

Stricter sustainability approach

Around 60% lower CO2 emissions²

Supports the UN Sustainable Development Goals³

Strong and Consistent Track Record

Here you can see the performance of three strategies each from the 'Global' and 'Green' series.

Here you can see the performance of three strategies each from the 'Global' and 'Green' series.

Global

Green

Global

Green

Global

Green

Global

Green

Your money is protected

Segregated asset

Your investment is treated as a segregated assets. This means you are 100% protected even if Ginmon or the partner bank becomes insolvent.

EU deposit insurance

In addition, the money you deposit in your settlement account is covered by the EU Deposit Guarantee Scheme and is therefore protected against default risks.

Your money is protected

Segregated asset

Your investment is treated as a segregated assets. This means you are 100% protected even if Ginmon or the partner bank becomes insolvent.

EU deposit insurance

In addition, the money you deposit in your settlement account is covered by the EU Deposit Guarantee Scheme and is therefore protected against default risks.

Your money is protected

Segregated asset

Your investment is treated as a segregated assets. This means you are 100% protected even if Ginmon or the partner bank becomes insolvent.

EU deposit insurance

In addition, the money you deposit in your settlement account is covered by the EU Deposit Guarantee Scheme and is therefore protected against default risks.

Your money is protected

Segregated asset

Your investment is treated as a segregated assets. This means you are 100% protected even if Ginmon or the partner bank becomes insolvent.

EU deposit insurance

In addition, the money you deposit in your settlement account is covered by the EU Deposit Guarantee Scheme and is therefore protected against default risks.

What our customers say

Brilliant automated ETF portfolio management, best-in-class returns with minimal effort. I can highly recommend Ginmon.

Soeren S.

I am absolutely satisfied and happy with the decision to switch to Ginmon. This was a few years ago, and the hard test of "Corona" was mastered with flying colors! I remain loyal to the great team behind Ginmon and continue to enjoy the perfect user interface... Here's to many more fruitful years ahead!!!

Marcel Kleinitz

I have already given Ginmon a top rating. After 5 years, I can definitely say the following: An unbelievably good performance and a wonderful, reliable service. Truly a top robo-advisor. In my opinion, no one can deliver better than Ginmon.

Sven F.

What our customers say

Brilliant automated ETF portfolio management, best-in-class returns with minimal effort. I can highly recommend Ginmon.

Soeren S.

I am absolutely satisfied and happy with the decision to switch to Ginmon. This was a few years ago, and the hard test of "Corona" was mastered with flying colors! I remain loyal to the great team behind Ginmon and continue to enjoy the perfect user interface... Here's to many more fruitful years ahead!!!

Marcel Kleinitz

I have already given Ginmon a top rating. After 5 years, I can definitely say the following: An unbelievably good performance and a wonderful, reliable service. Truly a top robo-advisor. In my opinion, no one can deliver better than Ginmon.

Sven F.

What our customers say

Brilliant automated ETF portfolio management, best-in-class returns with minimal effort. I can highly recommend Ginmon.

Soeren S.

I am absolutely satisfied and happy with the decision to switch to Ginmon. This was a few years ago, and the hard test of "Corona" was mastered with flying colors! I remain loyal to the great team behind Ginmon and continue to enjoy the perfect user interface... Here's to many more fruitful years ahead!!!

Marcel Kleinitz

I have already given Ginmon a top rating. After 5 years, I can definitely say the following: An unbelievably good performance and a wonderful, reliable service. Truly a top robo-advisor. In my opinion, no one can deliver better than Ginmon.

Sven F.

What our customers say

Brilliant automated ETF portfolio management, best-in-class returns with minimal effort. I can highly recommend Ginmon.

Soeren S.

I am absolutely satisfied and happy with the decision to switch to Ginmon. This was a few years ago, and the hard test of "Corona" was mastered with flying colors! I remain loyal to the great team behind Ginmon and continue to enjoy the perfect user interface... Here's to many more fruitful years ahead!!!

Marcel Kleinitz

I have already given Ginmon a top rating. After 5 years, I can definitely say the following: An unbelievably good performance and a wonderful, reliable service. Truly a top robo-advisor. In my opinion, no one can deliver better than Ginmon.

Sven F.

Other questions?

What is Ginmon?

Spelling: [ɡin moɴ]

Ginmon means "silver gate" in Japanese and is an independent WealthTech (Digital Asset Manager) founded in December 2014, consisting of a team of dynamic IT and finance experts.

Our goal is to provide an independent, automated, highly diversified and highly scientific investment for you, so that you can save money and time. Together we will find the way through the silver gate to the well-deserved prosperity for your financial goals.

“Many people overlook the silver lining because they are waiting for gold.”

(Maurice Setter)

What does Ginmon offer me?

Ginmon offers a transparent and fully automated investment solution that enables you to invest your saved wealth cost-effectively into established investment forms with a clear investment strategy and ease of use.

Through user-friendly technology combined with understandable investment products, Ginmon provides a completely new way of investing.

For more information on our investment strategies, please visit our Investment philosophy.

How does the registration process work?

First, you register and answer 8 questions about your investment goals.

This takes less than 3 minutes.

Now you will receive your personalized investment proposal.

Next, you verify your identity via video ident.

You then tell us how you would like to deposit your money into your custody account.

• via SEPA credit transfer

• via recurring SEPA credit transfer

• via SEPA direct debit

As soon as the money arrives, we invest it in your personalised ETF strategy.

Of course, you can change your strategy or deposit at any time, free of charge, or even have all your investments paid out.

What if I want my money? Do I have to wait?

No, you can withdraw your Ginmon deposit when you want.

You can pause your savings plan as often and as long as you want. No extra fees or lock-up periods.

What if Ginmon no longer exists?

Good question! Let's go through the worst-case scenarios.

Case 1 - Ginmon goes bankrupt.

In this very unlikely case, your deposit would remain unaffected.

The custody account is safely held at our partner bank.

Case 2 - The partner bank goes bankrupt.

Don't worry, this is also very unlikely.

In fact, your invested money is completely protected.

In this case, your securities are held in a so called “segregated account” that, in the worst case, is automatically transferred to a partner bank of your choice. There will be no change to your account, and you will remain invested.

Case 3 - The capital market collapses.

While capital markets are volatile, this is of less concern to the long-term investor.

The global capital market has, without exception, recovered after every crisis and achieved steady 6-7% p.a. returns over longer period of time.

Other questions?

What is Ginmon?

Spelling: [ɡin moɴ]

Ginmon means "silver gate" in Japanese and is an independent WealthTech (Digital Asset Manager) founded in December 2014, consisting of a team of dynamic IT and finance experts.

Our goal is to provide an independent, automated, highly diversified and highly scientific investment for you, so that you can save money and time. Together we will find the way through the silver gate to the well-deserved prosperity for your financial goals.

“Many people overlook the silver lining because they are waiting for gold.”

(Maurice Setter)

What does Ginmon offer me?

Ginmon offers a transparent and fully automated investment solution that enables you to invest your saved wealth cost-effectively into established investment forms with a clear investment strategy and ease of use.

Through user-friendly technology combined with understandable investment products, Ginmon provides a completely new way of investing.

For more information on our investment strategies, please visit our Investment philosophy.

How does the registration process work?

First, you register and answer 8 questions about your investment goals.

This takes less than 3 minutes.

Now you will receive your personalized investment proposal.

Next, you verify your identity via video ident.

You then tell us how you would like to deposit your money into your custody account.

• via SEPA credit transfer

• via recurring SEPA credit transfer

• via SEPA direct debit

As soon as the money arrives, we invest it in your personalised ETF strategy.

Of course, you can change your strategy or deposit at any time, free of charge, or even have all your investments paid out.

What if I want my money? Do I have to wait?

No, you can withdraw your Ginmon deposit when you want.

You can pause your savings plan as often and as long as you want. No extra fees or lock-up periods.

What if Ginmon no longer exists?

Good question! Let's go through the worst-case scenarios.

Case 1 - Ginmon goes bankrupt.

In this very unlikely case, your deposit would remain unaffected.

The custody account is safely held at our partner bank.

Case 2 - The partner bank goes bankrupt.

Don't worry, this is also very unlikely.

In fact, your invested money is completely protected.

In this case, your securities are held in a so called “segregated account” that, in the worst case, is automatically transferred to a partner bank of your choice. There will be no change to your account, and you will remain invested.

Case 3 - The capital market collapses.

While capital markets are volatile, this is of less concern to the long-term investor.

The global capital market has, without exception, recovered after every crisis and achieved steady 6-7% p.a. returns over longer period of time.

Other questions?

What is Ginmon?

Spelling: [ɡin moɴ]

Ginmon means "silver gate" in Japanese and is an independent WealthTech (Digital Asset Manager) founded in December 2014, consisting of a team of dynamic IT and finance experts.

Our goal is to provide an independent, automated, highly diversified and highly scientific investment for you, so that you can save money and time. Together we will find the way through the silver gate to the well-deserved prosperity for your financial goals.

“Many people overlook the silver lining because they are waiting for gold.”

(Maurice Setter)

What does Ginmon offer me?

Ginmon offers a transparent and fully automated investment solution that enables you to invest your saved wealth cost-effectively into established investment forms with a clear investment strategy and ease of use.

Through user-friendly technology combined with understandable investment products, Ginmon provides a completely new way of investing.

For more information on our investment strategies, please visit our Investment philosophy.

How does the registration process work?

First, you register and answer 8 questions about your investment goals.

This takes less than 3 minutes.

Now you will receive your personalized investment proposal.

Next, you verify your identity via video ident.

You then tell us how you would like to deposit your money into your custody account.

• via SEPA credit transfer

• via recurring SEPA credit transfer

• via SEPA direct debit

As soon as the money arrives, we invest it in your personalised ETF strategy.

Of course, you can change your strategy or deposit at any time, free of charge, or even have all your investments paid out.

What if I want my money? Do I have to wait?

No, you can withdraw your Ginmon deposit when you want.

You can pause your savings plan as often and as long as you want. No extra fees or lock-up periods.

What if Ginmon no longer exists?

Good question! Let's go through the worst-case scenarios.

Case 1 - Ginmon goes bankrupt.

In this very unlikely case, your deposit would remain unaffected.

The custody account is safely held at our partner bank.

Case 2 - The partner bank goes bankrupt.

Don't worry, this is also very unlikely.

In fact, your invested money is completely protected.

In this case, your securities are held in a so called “segregated account” that, in the worst case, is automatically transferred to a partner bank of your choice. There will be no change to your account, and you will remain invested.

Case 3 - The capital market collapses.

While capital markets are volatile, this is of less concern to the long-term investor.

The global capital market has, without exception, recovered after every crisis and achieved steady 6-7% p.a. returns over longer period of time.

Try it out now

With or without an investment goal. Create a

free investment proposal in just a few minutes.

Try it out now

With or without an investment goal. Create a

free investment proposal in just a few minutes.

Try it out now

With or without an investment goal. Create a

free investment proposal in just a few minutes.

⁴ Customer reviews come from Trustpilot or Google Reviews. Verification is not done by Ginmon, but by the respective review platforms. For more information on how these providers ensure the authenticity of reviews, you can find it here: Trustpilot / Google.

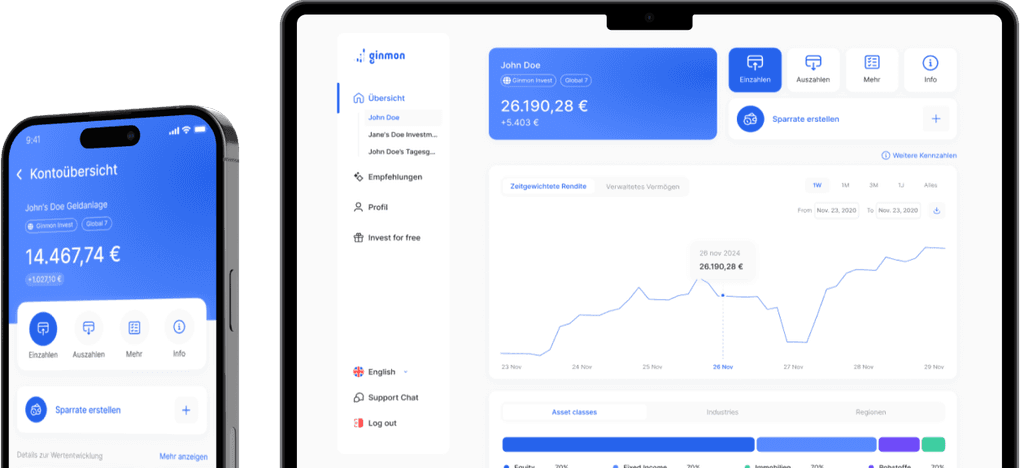

Get the app