Retirement Calculator

for Private Pensions

Your results

Other questions?

What assumptions does the pension calculator rely on?

Our assumptions for the individual personal details are as follows:

Costs: Our pension calculator is all-inclusive. This means all fees for Ginmon as well as the product costs of the ETFs we use are taken into account. You can learn more about our fees here.

Inflation: In our model, we assume an inflation rate, i.e., a price increase, of just under 2%, which corresponds to the ECB’s mandate for the euro area.

Taxes: For the sake of simplicity, taxes are continuously deducted from the yield in our calculations. The taxes every German must pay on capital gains amount to 26.375%. This consists of 25% capital gains tax and 5.5% solidarity tax. For investors who belong to a church, an additional church tax of 8% or 9% is added. This increases the overall tax rate to 27.8186% or 27.9951%, respectively. In our calculation, when selecting the “Subject to church tax?” option, a tax rate of 9% is applied.

The pension calculator’s logic is as follows:

Expected Return: The weekly average yield, which is based on historical data, is used for the calculation in the pension calculator. It’s important to note that past performance is not an indicator of future returns.

Expected Fluctuations: The expected fluctuations are calculated using the average standard deviation of the average return, which is also based on historical data.

Visualisation: The graph displays three possible developments. The light blue line represents an optimistic scenario, the 95th percentile. There’s a 5% probability of achieving a value above this. The orange line symbolizes the expected scenario, namely the 50th percentile. The dark blue line represents a pessimistic scenario, the so-called 5th percentile. There’s a 95% probability of achieving a value above this line.

Why is early retirement planning so important?

Due to demographic changes, the ratio of contributors to retirees is expected to change significantly in the future, hence a noticeable decline in the statutory pension level is anticipated. Company pensions are also not necessarily advantageous for everyone, especially considering that complications often arise with an employer change.

Therefore, one should start thinking about private pension provision early on. The foundation for later is laid in young years. That is why it is important to set aside money as soon as one enters the profession. With good planning, this is also possible with a smaller budget.

What are the three pillars of retirement provision?

In the three pillars of retirement provision, a distinction is made between statutory, occupational, and private retirement provision. The statutory retirement provision is a state pension scheme. It is financed through a pay-as-you-go system. This means that the contributions are not saved but paid out to current retirees (the so-called generational contract).

The occupational retirement provision arises from an agreement within an employment relationship. A distinction is made between employee and employer-funded occupational retirement provision.

With private retirement provision, the policyholder has a savings plan, where typically savings are accumulated through monthly contributions. From a contractually specified point in time, a certain amount can then be paid out monthly.

How does the registration process work?

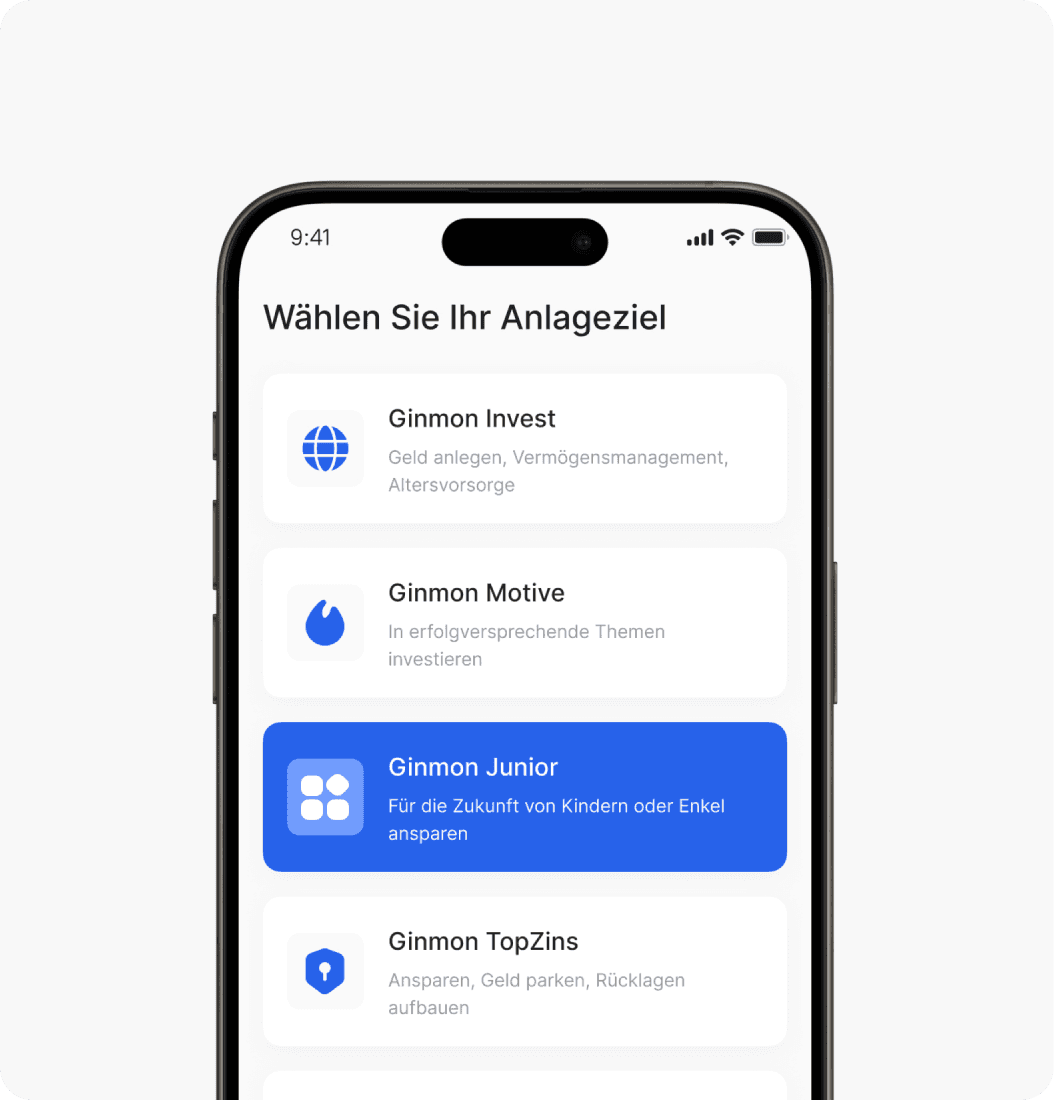

First, you register and answer 8 questions about your investment goals.

This takes less than 3 minutes.

Now you will receive your personalized investment proposal.

Next, you verify your identity via video ident.

You then tell us how you would like to deposit your money into your custody account.

• via SEPA credit transfer

• via recurring SEPA credit transfer

• via SEPA direct debit

As soon as the money arrives, we invest it in your personalised ETF strategy.

Of course, you can change your strategy or deposit at any time, free of charge, or even have all your investments paid out.

What does Ginmon offer me?

Ginmon offers a transparent and fully automated investment solution that enables you to invest your saved wealth cost-effectively into established investment forms with a clear investment strategy and ease of use.

Through user-friendly technology combined with understandable investment products, Ginmon provides a completely new way of investing.

For more information on our investment strategies, please visit our Investment philosophy.

Your path to retirement plan with Ginmon