Invest simplyintelligently

- with a science-based investment strategy

- based on low-cost ETFs

- with professional risk management

We invest in the best selection of ETFs for you, so you can see up to 6.7% annual growth in the value of your portfolio. That’s why investors in Germany now entrust more than €300 million to us.

Unlike many digital investments, Ginmon offers the best of both worlds

*after fees and taxes, return on medium risk portfolios over 4 years

Our team in Frankfurt does the hard work while you relax and remain in full control of your investments. You specify how you want to invest and what is important to you, and we make it happen.

No, you can withdraw your Ginmon deposit when you want.

You can pause your savings plan as often and as long as you want. No extra fees or lock-up periods.

Good question! Let's go through the worst-case scenarios.

Case 1 - Ginmon goes bankrupt.

In this very unlikely case, your deposit would remain unaffected.

The custody account is safely held at our partner bank.

Case 2 - The partner bank goes bankrupt.

Don't worry, this is also very unlikely.

In fact, your invested money is completely protected.

In this case, your securities are held in a so called “segregated account” that, in the worst case, is automatically transferred to a partner bank of your choice. Three will be no change to your account, and you will remain invested.

Case 3 - The capital market collapses.

While capital markets are volatile, this is of less concern to the long-term investor.

The global capital market has, without exception, recovered after every crisis and achieved steady 6-7% p.a. returns over longer period of time.

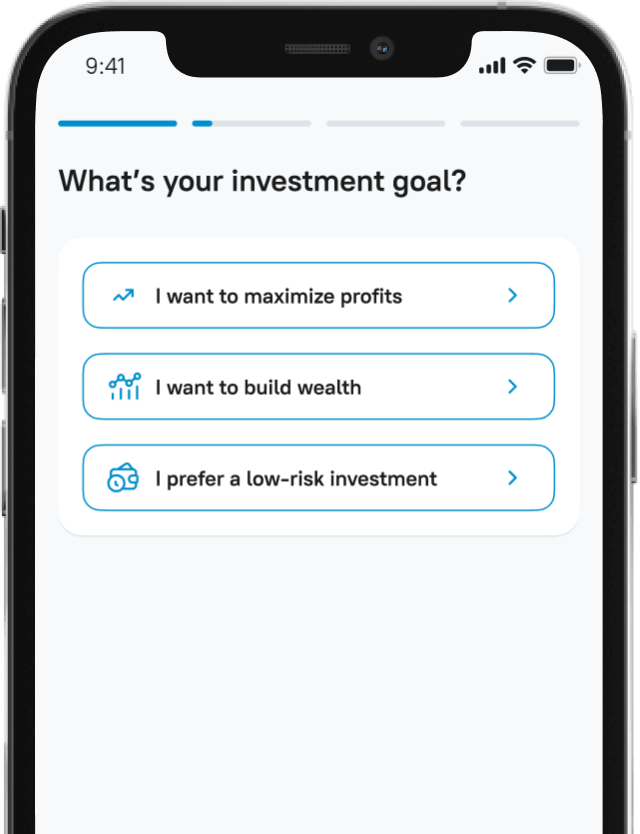

First, you register and answer 8 questions about your investment goals.

This takes less than 3 minutes.

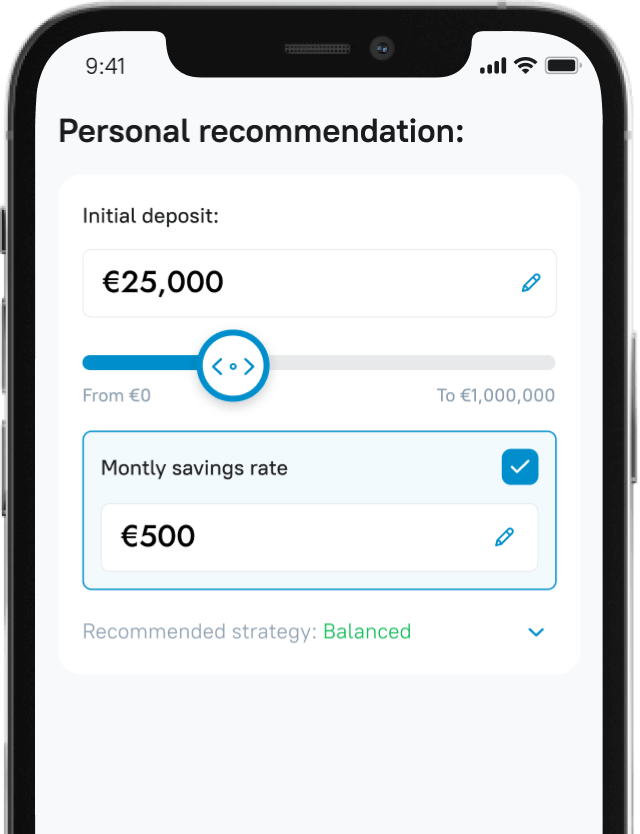

Now you will receive your personalized investment proposal.

Next, you verify your identity via video ident.

You then tell us how you would like to deposit your money into your custody account.

• via SEPA credit transfer

• via recurring SEPA credit transfer

• via SEPA direct debit

As soon as the money arrives, we invest it in your personalized ETF strategy.

Of course, you can change your strategy or deposit at any time, free of charge, or even have all your investments paid out.

Together, we create your individual investment strategy.

This is based on your personal risk appetite and your experience in the capital market. Through this assessment, we make sure that you sleep tight, independent of market volatility or macroeconomic uncertainties.

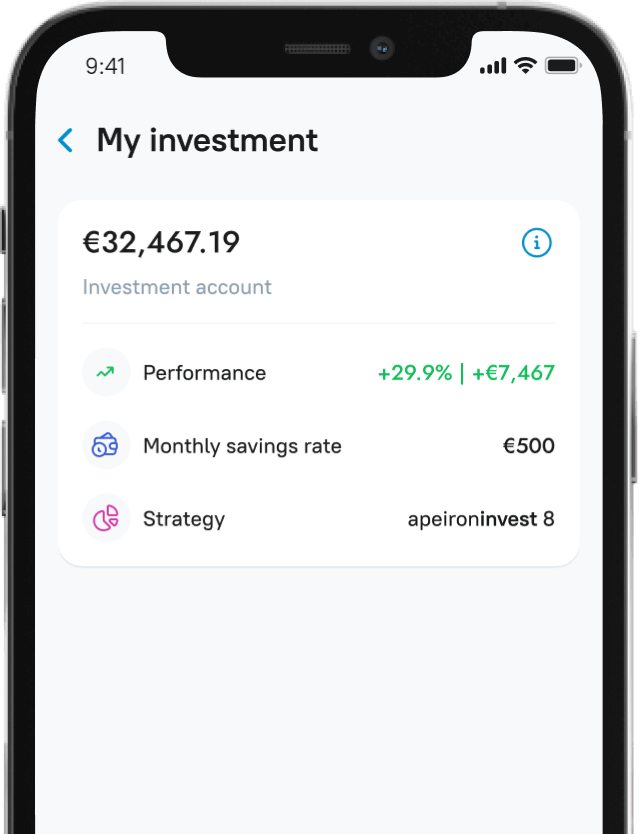

We open your custody account and automatically invest your money.

We keep an eye on your investment every day and ensure that it always corresponds to your personal preferences.

Once you are set up, you may or may not check it regularly. Your investment grows over time, independent on how active you are.

However, you have full flexibility. Deposits and withdrawals are possible at any time.

© Ginmon Vermögensverwaltung GmbH